When it comes to managing your finances, most people are familiar with traditional banks, whether they’re brick-and-mortar institutions or online banks. But if you were to ask someone about credit unions, many might not know exactly what they are or how they work. While they’ve been around for more than a century, credit unions often remain a bit of a mystery.

In this post, we’ll break down what credit unions are, how they differ from traditional banks, the products they offer, and how to decide whether one might be right for you.

What Exactly is a Credit Union?

A credit union is a non-profit financial institution owned by its members, who are also its customers. The purpose of a credit union is to serve its members, not to make profits. This makes credit unions unique, as any profits they make are reinvested into the institution or returned to members in the form of lower fees, better interest rates, and other benefits.

The idea of a credit union is rooted in community. Members typically share a common bond, such as where they live, work, or worship, or even their association with certain groups. This shared connection helps foster a sense of ownership and participation in the institution.

While credit unions and banks offer similar financial products, such as savings accounts, checking accounts, and loans, the way they are structured and how they operate sets them apart. Credit unions are also federally insured by the National Credit Union Administration (NCUA), which is similar to the FDIC insurance for banks. Your money is safe, with up to $250,000 in deposits covered by the NCUA.

How Do Credit Unions Operate?

One of the key characteristics of credit unions is that they are cooperatives. This means they are run by members and for the benefit of members. When you become a member of a credit union, you essentially become an owner of that institution. You also have voting rights, allowing you to participate in decision-making and elect a board of directors who oversee the institution.

To join a credit union, you typically need to open a savings account, often referred to as a share account, with a small deposit—usually between $5 and $25. Membership eligibility varies depending on the credit union, but you may be able to join based on your employer, your place of residence, or even through a donation to a partner charity.

Credit unions are not driven by profit-making motives. Instead, they aim to provide better rates on savings and loans and more personalized customer service, reflecting their community-oriented structure.

Credit Unions vs. Banks: What’s the Difference?

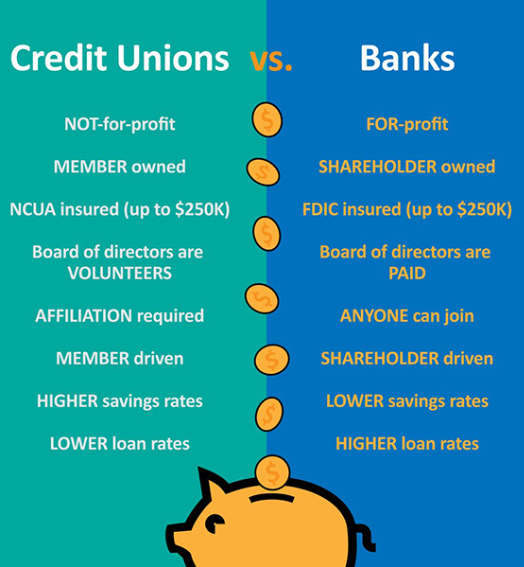

While credit unions and banks both provide financial services, they operate very differently. Here are some of the key differences:

- Profit vs. Non-Profit: Banks are for-profit institutions, meaning their primary goal is to generate profits for shareholders. Credit unions, on the other hand, are non-profit organizations that exist to serve their members. Any profit they make is returned to members through better interest rates or lower fees.

- Membership: To open an account at a credit union, you need to meet certain membership criteria. For example, you may need to live in a specific area, work for a particular employer, or be a part of an association. Banks, on the other hand, are open to the public and don’t require membership.

- Fees: Credit unions generally have lower fees than banks. Many banks charge maintenance fees for savings or checking accounts, but most credit unions do not.

- Interest Rates: Credit unions often offer better interest rates on savings accounts and loans than banks. Since credit unions are non-profit, they can pass along the savings to their members in the form of lower loan rates and higher deposit rates.

- Technology: While some credit unions offer online and mobile banking services, they typically lag behind banks when it comes to tech offerings. However, many credit unions are working to improve their digital services and some have made significant progress in this area.

What Services Do Credit Unions Offer?

Credit unions offer many of the same products and services you would find at a bank, including:

- Checking Accounts

- Savings Accounts (often called Share Accounts)

- Money Market Accounts

- Health Savings Accounts (HSA)

- Individual Retirement Accounts (IRA)

- Mortgages and Home Loans

- Auto Loans and Personal Loans

- Credit Cards

- Certificates of Deposit (CDs)

In addition to these standard offerings, many credit unions provide special accounts for members, such as holiday savings accounts or club accounts, designed for specific savings goals.

The Pros and Cons of Credit Unions

While credit unions offer numerous benefits, they may not be the best fit for everyone. Here’s a quick breakdown of the pros and cons:

Pros:

- Lower Fees: Credit unions often have fewer fees compared to banks.

- Better Rates: Credit unions tend to offer higher interest rates on savings and lower rates on loans.

- Personalized Service: Since credit unions are member-owned, customer service tends to be more personalized and attentive.

- Community Focus: Credit unions tend to support local communities through loans and initiatives.

Cons:

- Limited Branch Access: Many credit unions have fewer physical locations than larger banks, although they often participate in shared branch networks.

- Fewer Products: Credit unions may offer fewer financial products than larger banks, especially when it comes to investment and commercial banking services.

- Technology: Some credit unions lag behind big banks in terms of technology, such as mobile apps and digital banking features.

Should You Join a Credit Union?

Whether a credit union is right for you depends on your personal financial needs and preferences. If you value lower fees, higher savings rates, and personalized customer service, a credit union might be a great fit. However, if you require a wide range of financial products or prefer the convenience of numerous physical locations, a traditional bank might be a better choice.

You may also consider using both types of institutions to enjoy the best of both worlds—having a credit union for savings and a bank for everyday checking or specialized services. Before making a decision, it’s worth comparing the specific credit unions available to you and considering their offerings, membership requirements, and overall benefits.

发表回复