Want to take control of your finances and handle your money like a pro? The first step is learning how to track your spending effectively.

Tracking your expenses is simple, but it’s one of those things that can easily get overlooked. It’s not hard to do, but actually sticking with it can be a challenge, especially if you’re not sure where to begin. The good news is, I’m here to guide you through it!

Tracking your spending can change everything about your financial life. Let’s dive into why it’s important and how you can get started right away.

Why Tracking Your Spending is Essential

If you’re serious about improving your finances, tracking your expenses is crucial. Whether you’re paying off debt, learning how to budget, or just looking to make sure your bank account stays healthy, understanding where your money is going is key to taking control of your financial situation.

Most people think they have their finances under control as long as they can pay the bills. However, what often happens is that after covering the bills, money quietly disappears—on small, unnoticed expenses. By tracking your spending, you’ll finally have clarity on how your income is being spent.

For us, it was an eye-opening experience. Despite making decent money, we had no idea how much we were actually wasting. After a simple change—tracking our expenses—we uncovered a lot of unnecessary spending that was holding us back. Once we identified the problem, we could make intentional changes and started saving money every month.

Our Story: From Overspending to Saving

A few years ago, my wife Holly and I were doing well financially in terms of income, but we were still drowning in debt and had little savings. We considered ourselves frugal, but we had no idea how much we were wasting until we started tracking our spending.

After the birth of our first child, we took a hard look at our finances. We started tracking every dollar spent, and the results were shocking. We were paying over $100 a month for cable and spending more than $1,000 monthly on food—just for two adults and a baby. This was money we didn’t need to spend, and it was disappearing without us noticing.

Once we got a handle on tracking our expenses, we were able to adjust our spending. We cut down on unnecessary expenses, created a budget, and started paying off our debt. Fast forward a few years, and we’re now debt-free (except for our mortgage), and we’ve been able to take risks like quitting our jobs, working for ourselves, and even traveling the world—all because we learned how to track and manage our money.

3 Ways to Track Your Spending

If you’re ready to take control of your money, here are three ways you can track your spending:

1. Pen and Paper

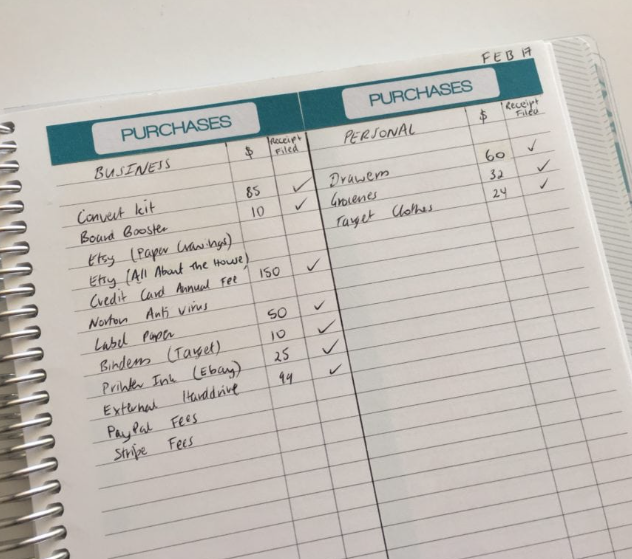

Yes, it can be as simple as pen and paper. Grab two sheets—one for your “Spending Journal” and one for your “Monthly Expense Record.”

- Spending Journal: This should have three columns: Name of Expense, Category, and Dollar Amount. Every time you spend, write it down.

- Monthly Expense Record: At the end of the month, tally up the expenses by category and record the total.

This is a straightforward, manual way to track your spending, and it’s a great place to start if you’re new to budgeting.

2. Create a Spreadsheet

If you’re a little more tech-savvy, you can create a spreadsheet to track your expenses. This allows you to keep a running total of your spending without having to do manual calculations. You can also categorize your expenses for easier tracking. If you want an even simpler option, you can use a free budget template that totals your expenses automatically.

3. Automate with an App

For a hands-off approach, consider using an app like Personal Capital. After linking your bank accounts and credit cards, the app automatically tracks your spending by category. You won’t need to manually input anything, and it’ll give you an up-to-date snapshot of your finances. This method works best if most of your spending is digital, though, so it may not be as effective if you deal mostly in cash.

What to Do After You Track Your Spending

Once you’ve tracked your spending for a month, take a moment to celebrate! You’ve done more than most people ever will when it comes to understanding your finances.

Now, the real work begins: analyzing your spending. You’ll likely feel a bit shocked or overwhelmed by the totals, and that’s okay. The important thing is not to panic but to use that feeling as motivation for change.

Start by reviewing your categories and identifying areas where you can cut back. Are there expenses you can reduce or eliminate? For example, you could cancel subscriptions you don’t use or switch to cheaper alternatives. Make sure you’re focusing on your “wants” first, then look at your “needs” and see if there’s room to trim.

The key is to keep making small adjustments every month. Over time, you’ll start to see significant savings.

Conclusion

Tracking your spending is a simple but powerful way to take control of your finances. Whether you use pen and paper, a spreadsheet, or an automated app, the important thing is to track your expenses consistently. Once you do, you’ll have a clearer understanding of where your money is going, which will allow you to make smarter financial decisions and start saving more.

Take the first step today and see how tracking your spending can completely transform your financial future. You’ve got this!

发表回复