In today’s unpredictable fixed-income market, private credit investing has emerged as an attractive option for high-net-worth individuals and families looking to diversify their portfolios. With the potential for higher yields and unique structures, private credit offers investment opportunities not readily available to most retail investors.

As institutional capital continues to flow into this sector, many ultra-high-net-worth (UHNW) investors are asking themselves, “Is private credit a smart investment?” and “How can I use private credit to boost returns while managing risk?”

The answers are not always straightforward. Before committing to these types of investments, it’s important to understand their characteristics, investment methods, and associated risks.

At Avidian Wealth Solutions, we offer qualified investors access to exclusive private credit opportunities that may not be found on traditional investment platforms. Our team helps evaluate whether these strategies align with your investment goals and risk appetite. Reach out to us today to learn how our personalized private credit solutions can enhance your portfolio.

What is Private Credit Investing?

Private credit involves lending to businesses or individuals outside of traditional banking systems. These loans can range from direct lending to structured credit deals and distressed debt investments. Investors in private credit earn returns primarily from interest payments and potential increases in the value of the debt instruments.

Unlike public bonds, private credit agreements are typically negotiated directly between lenders and borrowers, allowing for more flexible terms. While this flexibility can offer customized risk-reward profiles, it also necessitates careful due diligence and ongoing monitoring.

Key Real-World Applications of Private Credit

Private credit is not just a theoretical concept; it plays a vital role in today’s financial markets. Here are some areas where private credit is having a major impact:

- Middle-Market Business Growth: Many privately held businesses face difficulties obtaining traditional bank loans or prefer the flexibility of private financing. Private credit provides capital for expansion, acquisitions, or operational upgrades, offering strong returns for investors.

- Real Estate and Infrastructure Development: Private credit is often used to fund major real estate projects such as commercial developments, multifamily housing, and infrastructure improvements. These asset-backed loans can offer stable, collateralized returns.

- Corporate Debt Refinancing: Businesses with high-interest debt often turn to private credit to refinance at more favorable terms, reducing default risks and improving financial health.

- Venture Debt for Startups: Startups in fast-growing sectors may require funding beyond equity financing. Venture debt enables them to raise capital while maintaining control of the business, offering investors a chance to tap into high-growth industries without the risks of direct equity investment.

Private Credit vs. Private Equity: Understanding the Differences

While private credit and private equity are often confused, they are distinct strategies with different goals and risk profiles. Here’s a breakdown of their differences:

| Private Credit Investing | Private Equity Investing |

|---|---|

| Loans to businesses/individuals | Equity stakes in companies |

| Lower risk (secured by assets) | Higher risk (depends on company performance) |

| Predictable returns from interest | Potential for high long-term gains |

| Low liquidity (long-term commitments) | Very low liquidity (capital locked in for years) |

| Limited investor involvement | High involvement, often requiring active management |

| More stable, less correlated with public markets | Highly sensitive to market cycles and trends |

What Are the Top Private Credit Strategies?

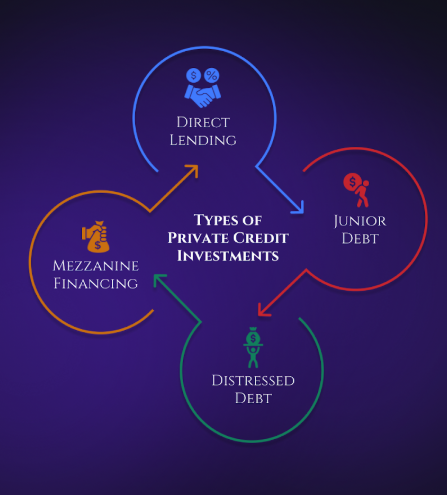

There is no one-size-fits-all approach to private credit investing. Strategies should reflect an investor’s risk tolerance, liquidity needs, and expected returns. However, some popular private credit strategies include:

- Direct Lending: This involves providing loans directly to middle-market companies, often with structured terms and collateral. It offers attractive yields but requires careful risk management.

- Distressed Debt: Investors buy the debt of struggling companies at a discount, with the potential for high returns if the company recovers. This strategy carries higher risks but can be highly profitable.

- Mezzanine Financing: Combining elements of debt and equity, mezzanine loans offer higher yields in exchange for subordinated debt, often including equity kickers like warrants or convertible options.

- Asset-Based Lending (ABL): These loans are secured by tangible assets such as real estate or equipment, providing a safety net for lenders while offering stable returns.

- Special Situations Lending: This focuses on unique opportunities such as bridge loans, litigation finance, or niche markets where traditional banks may not operate.

At Avidian, we offer a personalized approach, ensuring our clients have access to private credit strategies that fit their financial objectives and risk profiles.

Understanding the Risks of Private Credit Investing

While private credit investments can be profitable, they come with inherent risks. Key risks include:

- Credit Risk: Borrowers may default on their loans, leading to potential losses. Proper due diligence and strong underwriting practices can mitigate this risk.

- Liquidity Risk: Private credit investments are often illiquid, making it difficult for investors to exit their positions quickly.

- Interest Rate Risk: Changes in interest rates can impact the value and returns of private credit investments, especially those with floating rates.

- Market and Regulatory Risks: Economic downturns, regulatory changes, and fluctuations in borrower creditworthiness can affect private credit markets.

Effective portfolio construction and risk management strategies can help investors navigate these risks.

How Professional Investment Management Can Help

For UHNW investors interested in private credit, professional investment management offers valuable benefits. Avidian Wealth Solutions provides access to private credit opportunities with lower minimum investments than large firms, allowing investors to participate in diversified portfolios without committing excessive capital upfront.

Working with a professional firm ensures rigorous due diligence, with a comprehensive evaluation process to assess borrower creditworthiness and optimize loan terms. Moreover, a trusted wealth advisor provides ongoing monitoring, ensuring that investments are actively managed and adjusted to changing market conditions and borrower performance.