Saving money effectively is crucial for long-term financial health. While it’s easy to fall into the habit of leaving your funds in a traditional bank account, high-yield savings accounts offer a better way to grow your money. One such option worth considering is the American Express Personal Savings account, which is known for its solid interest rates and simple terms. If you’re in the market for a high-yield savings account, here’s everything you need to know about the American Express Personal Savings account.

What is the American Express Personal Savings Account?

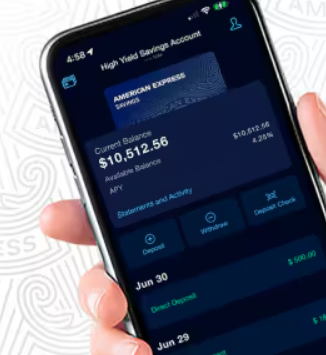

The American Express Personal Savings account is an online savings option that allows you to earn higher interest rates than traditional savings accounts. With no minimum deposit required, this account is accessible for anyone, and you start earning interest as soon as you deposit money. Additionally, your deposits are protected by FDIC insurance, which adds a layer of security.

This account operates solely online, which means you won’t have access to physical branches, but you can still manage your account via their easy-to-use online platform or mobile app. You can link your existing bank accounts to fund the account or make transfers. If needed, you can also deposit checks by mailing them in.

How to Access Your Funds

The American Express Personal Savings account doesn’t come with ATM or debit card access, which means you won’t have instant access to your funds. While this might seem like a downside, it can actually be beneficial in encouraging better saving habits. Without immediate access to your money, it’s easier to resist the temptation to spend.

To access your funds, you can initiate a transfer to a linked account. This process usually takes about one to three business days. While this doesn’t provide instant access, it does give you a secure and controlled method to withdraw money when necessary.

Why Choose American Express Personal Savings?

There are several benefits that make the American Express Personal Savings account an attractive option for savers:

- High Interest Rate: One of the biggest draws of this account is the competitive interest rate. Compared to the national average for traditional savings accounts, which is often less than 0.05%, the American Express Personal Savings account offers a significantly better rate, helping your savings grow faster.

- No Minimum Deposit: You don’t need a huge sum of money to open the account. With just $1, you can start earning interest immediately, which makes this account accessible for anyone, regardless of how much they can deposit initially.

- No Fees: There are no monthly maintenance fees, no charges for transferring money, and no penalties for prepaying. This means your money stays with you, working for you, without losing a chunk to fees.

- Automation: One of the easiest ways to ensure you reach your savings goals is by setting up automatic transfers. With the American Express Personal Savings account, you can schedule automatic transfers from your linked accounts, making saving effortless.

Where the American Express Personal Savings Account Falls Short

While the American Express Personal Savings account offers many advantages, there are a couple of downsides to consider:

- No Debit or ATM Access: The account doesn’t provide immediate access to your funds via debit card or ATMs, which may be inconvenient for those who prefer instant access to their money. However, this feature can also help prevent unnecessary spending.

- Online Only: Since the account is entirely online, you won’t have the option to visit a branch if you need assistance. However, you can manage everything digitally, and customer support is available if you need help.

How to Use the American Express Personal Savings Account

Here are some smart ways to use your American Express Personal Savings account:

- Standalone Savings: Keeping your savings separate from your checking account makes it harder to dip into those funds. Use this account to set aside money for a rainy day, a future purchase, or any specific financial goal.

- Vacation Fund: If you love to travel but want to avoid credit card debt, setting up a vacation fund in this account can be a great idea. The higher interest rate will help your money grow, making your travel dreams more attainable.

- Emergency Fund: Having an emergency fund is essential to protect yourself from unexpected expenses. This account is a great place to build your emergency fund, ensuring your savings grow while staying separate from your daily spending.

- Holiday Savings: The holidays can get expensive, but with this account, you can plan ahead. Set up automatic transfers throughout the year, and you’ll have a budget for gifts and travel when the season arrives.

The Verdict: Is the American Express Personal Savings Account Right for You?

If you’re looking for a high-yield savings account that offers competitive interest rates with no fees, the American Express Personal Savings account is a solid choice. The absence of a minimum deposit requirement and the ability to automate savings make it an excellent option for anyone looking to save more effectively.

While the lack of immediate access to your funds might be a drawback for some, it’s also a built-in deterrent for impulse spending, making this account ideal for those who want to save without constant temptation.

Whether you’re building an emergency fund, saving for a vacation, or preparing for a major purchase, the American Express Personal Savings account can help you grow your money and reach your financial goals faster.

发表回复