Credit unions might not be as familiar to most people as traditional banks, but they offer many similar services with a few key differences. One of the biggest distinctions is how your deposits are protected. While banks are insured by the FDIC, credit unions are protected by the National Credit Union Administration (NCUA). This article takes a closer look at what the NCUA is, how it works, and how it protects your money.

Understanding the NCUA

The National Credit Union Administration (NCUA) is a federal agency created in 1970 to oversee and regulate federal credit unions. Much like the FDIC for banks, the NCUA ensures that your deposits in federally chartered credit unions are safe. Its mission is to protect the interests of credit union members and maintain the stability of credit unions across the country.

The NCUA performs several important functions, including:

- Chartering federal credit unions

- Establishing regulations for credit unions

- Monitoring the activities of credit unions

- Insuring deposits in federal credit unions

The NCUA is managed by a three-member Board of Directors, appointed by the president of the United States and confirmed by the Senate. The chairman of this board is designated by the president.

Key Features of the NCUA

- Founded: 1970 by the U.S. Congress

- Role: Regulates and insures federal credit union deposits up to $250,000 per depositor, per institution, through the National Credit Union Share Insurance Fund (NCUSIF)

- Supervision: Oversees over 9,500 federally chartered credit unions in the U.S.

- Headquarters: Alexandria, Virginia, with regional offices in Austin, Texas, and Tempe, Arizona

What Does the NCUA Insure?

If you have an account at a federal credit union, your deposits are insured by the NCUA, which means your money is protected in case the credit union fails. Here are the types of accounts that the NCUA insures:

- Savings accounts

- Checking accounts

- Money market accounts

- Joint accounts

- Trust accounts

- Traditional and Roth IRAs

- Keogh (retirement) plans

However, the NCUA does not cover investments like mutual funds, stocks, bonds, or life insurance policies.

Coverage Limits

The NCUA insures your money up to $250,000 per depositor, per credit union. This coverage applies to the total of all accounts you have with the same credit union, not per account. For joint accounts, coverage is up to $250,000 for each account holder. Trust accounts have the same coverage limits, and if the balance exceeds $1.25 million, different rules may apply.

What is the National Credit Union Share Insurance Fund (NCUSIF)?

The National Credit Union Share Insurance Fund (NCUSIF) was established alongside the NCUA to insure deposits at credit unions. Initially, it insured up to $20,000 in deposits per account holder, but today, it provides protection up to $250,000 per depositor. The NCUSIF is backed by the federal government, ensuring that deposits are safe.

How to Verify if Your Credit Union Is Federally Insured

You can easily verify whether your credit union is federally insured by looking for the NCUA insurance sign. This sign is required to be displayed in credit unions, usually near teller stations or on their website. Alternatively, you can use the NCUA’s credit union locator tool to find out if your credit union is insured.

Filing a Complaint with the NCUA

If you encounter issues with your credit union and can’t resolve them directly, the NCUA provides options to file a complaint. You can file a complaint through their online portal or by downloading one of their complaint forms. For additional support, the NCUA offers assistance via phone at (800) 755-1030 during business hours.

Frequently Asked Questions About Credit Unions

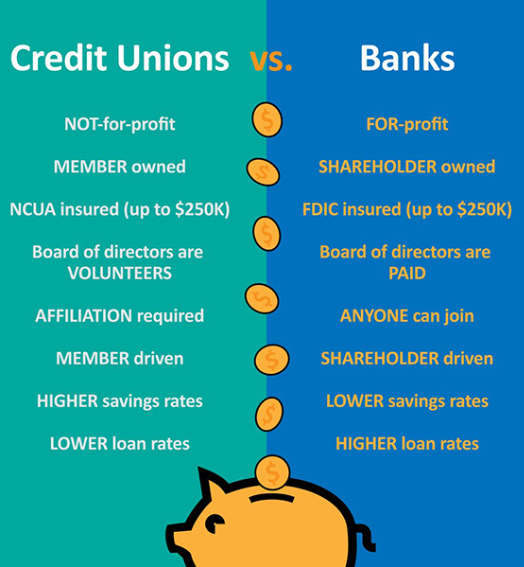

What’s the Difference Between a Credit Union and a Bank?

Credit unions are non-profit, member-owned financial institutions, while banks are for-profit corporations. To use a credit union’s services, you need to become a member, while banks are open to anyone. Since credit unions are non-profits, they tend to offer lower fees, higher savings rates, and better loan terms than banks.

How Are the FDIC and NCUA Different?

Both the FDIC and the NCUA serve similar functions but for different types of institutions. The FDIC insures deposits at banks, while the NCUA does the same for credit unions. Both provide protection up to $250,000 per depositor, per institution.

How Do I Become a Member of a Credit Union?

Membership requirements vary between credit unions. Some may require you to work for a certain employer, live in a specific area, or be part of an organization. Many credit unions offer membership to anyone who meets the criteria.

How Much Does It Cost to Join a Credit Union?

Most credit unions charge a small fee to join, typically between $5 and $25, which is used as a share in the credit union.

Should I Choose a Credit Union or a Bank?

Both credit unions and banks offer similar services, but credit unions are often more beneficial due to their non-profit status. While banks may offer more services, credit unions tend to offer better rates, lower fees, and a more personalized customer service experience.

Final Thoughts

The NCUA plays a vital role in ensuring that the money you deposit at federally insured credit unions is safe and secure. If you’re considering joining a credit union, make sure it’s federally insured to enjoy the peace of mind that your deposits are protected. Whether you choose a bank or a credit union, look for an institution that offers the services you need and that keeps your money safe.